What are the current drivers of the maritime sector? Where are shipowners, shipyards and suppliers identifying new opportunities, and where are the challenges? Questions Hamburg Messe und Congress (HMC) and the market research firm mindline have jointly explored for the fifth time. Every two years, the SMM Maritime Industry Report evaluates market participants’ current expectations regarding the development of the shipping and shipbuilding segments.

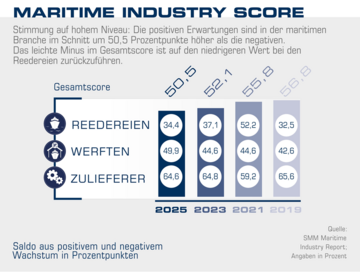

“The industry continues to grow dynamically, setting a strong signal in times of rapid change,” said Claus Ulrich Selbach, Vice President Exhibitions – Maritime & Energy at HMC. At 50.5 points, the Maritime Industry Score – which expresses the difference between positive and negative market expectations on a scale from -100 to +100 – clearly indicates an optimistic outlook. Despite a slight decline from 2023, the overall level remains high.

The industry outlook in numbers

Shipowners: 34.4 points (2023: 37.1) – slightly more moderate than in the previous survey

Shipyards: 49.9 points – the highest value since the initial survey

Suppliers: 64.6 points – remaining at a very high level

Key concerns: shortage of skilled labour, energy costs, bureaucracy

For the first time, the study reveals the most pressing challenges troubling companies. At the top of the list: the shortage of skilled professionals, high energy costs, and an increasing regulatory burden. “SMM 2026 will make a point of addressing these issues,” says Christoph Lücke, Director – SMM. The Maritime Career Market at SMM will bring together job seekers and employers. Furthermore, numerous exhibitors will showcase efficiency-enhancing and energy-saving solutions. Meanwhile, classification societies and software developers are dedicated to helping the sector find economically feasible and practicable ways to comply with environmental and climate protection regulations.

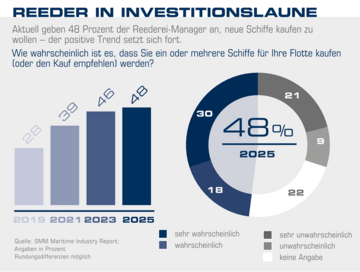

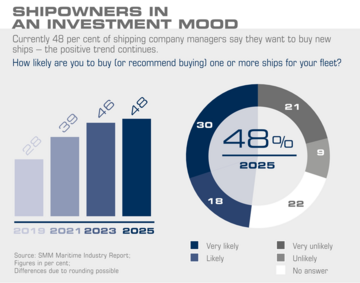

Investment readiness reaches record level

Sustainability remains a top issue. Six out of ten respondents expect growing pressure to modernise their fleet for maximum energy efficiency. Data-driven solutions are especially in demand; their relevance has increased by 13 percentage points from the previous survey. Artificial Intelligence is likewise gaining in importance and will be a key topic at SMM 2026 once again.

But enterprises are also planning major investments in new hardware:

48 per cent of shipowners say they are “likely” or “very likely” to order new ships by 2026, a new peak value in the MIR report.

The most sought-after ship types include:

Containerships (ten percentage points up from 2023)

RoRo and passenger ferries

Cruise ships

Naval vessels, including the entire range of submarines and combat vessels, from patrol boats through to supply vessels

“The volatile global political environment, marked by numerous conflicts which have a direct impact on the maritime world, is clearly leaving its mark,” commented Dr. Klaus Borgschulte, shipyard manager and Chairman of the SMM Advisory Committee.

Quality and service excellence as key success factors

Apart from sustainability, suppliers are seeing a sharpened focus on after-sales services and product longevity. “Quality is becoming the most important success factor,” observed Hauke Schlegel, CEO at VDMA Marine Equipment and Systems. One of the reasons is increasingly strict regulations. “Shipowners can no longer afford breakdowns. Maximum reliability is crucial, especially for non-redundant systems such as exhaust gas cleaning or ballast water management equipment,” said Richard von Berlepsch, long-serving fleet manager at Hapag-Lloyd.

SMM 2026: platform for innovation and cooperation

SMM Director Christoph Lücke believes these to be perfect conditions for the forthcoming leading international maritime trade fair: “SMM 2026 is the meeting place of the quality leaders of the global maritime industry. It is not only a marketplace for innovative technology but also a platform for establishing cooperation partnerships and exchanging knowledge that drives the industry forward.”

Summary of key findings

The SMM Maritime Industry Report 2025 shows that the maritime industry is launching an investment drive. The Maritime Industry Score has reached 50.5 points. Shipyards (49.9) and suppliers (64.6) have especially positive expectations, and shipowners (34.4) remain optimistic. Key challenges include the shortage of trained professionals, high energy costs, and compliance with strict regulations. 60 per cent are feeling growing pressure to upgrade their fleets to maximise energy efficiency. The importance of AI and data-driven solutions has increased substantially (+13 percentage points). 48 per cent of shipowners are planning to order newbuilds by 2026. SMM 2026 in Hamburg from 1 to 4 September 2026 becomes the principal platform for innovation and cooperation.

About SMM

The leading international maritime trade fair takes place in Hamburg from 1 to 4 September 2026. More than 2,200 exhibiting companies and around 48,000 visitors from over 100 countries are expected to attend. Covering the entire value chain of the maritime industry on roughly 90,000 m² in twelve exhibition halls, SMM is the foremost platform for innovation and the latest technologies in the maritime sector that brings together business leaders from around the world.

Themed “SMM – driving the maritime transition”, the 2026 event will put the spotlight on the maritime energy transition and the digital transformation. It is accompanied by an attractive conference programme on open stages, accessible at no extra cost, as well as various networking opportunities.

SMM – driving the maritime transition | 1–4 September 2026 - SMM

About the MIR

The SMM Maritime Industry Report is a vital mood barometer for the global maritime industry. The survey among trade fair visitors and exhibitors is conducted every two years by Hamburg Messe und Congress, the organiser of SMM, jointly with the market research firm mindline. The current survey was taken by nearly 1,500 executives from shipowning companies, shipyards and suppliers, exceeding the participation in the previous study by more than one third. 70 per cent of respondents play key roles in their companies’ purchasing decisions.